Sub-Division of Ledger

When the size of organisation is very large and number of accounts is abundant, it is necessary to maintain a separate ledger for different accounts. Generally, the following three kinds of ledger are maintained by organisations:

Debtor’s Ledger: Debtors are the clients of the business to whom goods are sold on credit. Debtor‟s ledger contains all the details of transactions with debtors. Entries in this ledger are made mostly from sales day books, sales returns book and cashbook. Therefore, it is also called as Sales ledger.

Creditor’s Ledger: Creditors are suppliers of the material to business from whom goods are purchased on credit. Purchase day books, purchase return book are one of the main sources of entries for this ledger. Therefore, it is also known as Purchase Ledger.

General Ledger: This ledger contains all residual accounts – mainly real and nominal accounts. This ledger is also called nominal ledger.

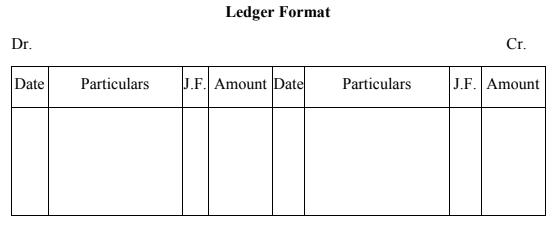

Ledger Format

Ledger accounts are represented in “T” format. This consists of two sides, the left side represents the debit side and the right side represents credit side. Each side divided into four columns of varying sizes for the following:

- Date – used for date of transaction

- Particulars – Recording the name of the accounts debited or credited

- Journal Folio (J.F) – used to mark the page number of the journal for which the transaction is being recorded.

- Amount – Recording the amount debited or credited

Ledger Posting

Ledger posting can be understood as the system of transferring of the debits and credits from the journal to the ledger accounts. It should be kept in the mind that the exact names of accounts used in the Journal should be carried to the Ledger. Posting may be done at any time but should be completed before the financial statements are prepared. It is advisable to keep more active accounts posted to date.

As we know under double entry system, each transaction is transferred in two different ledger accounts, affecting the debit side of one and credit side of the other one. The following procedure is followed for posting:

1. Open separate ledger account for posting transactions relating to different accounts.

2. Consider each transaction separately for posting purposes.

3. Locate the transaction in Journals, to be posted in the ledger.

4. Locate in the ledger the first account named in the journal.

5. Enter the date of the transaction in the date column as per the dates of journal entry.

6. In the particular column of the ledger books‟ debit side, enter the name of the account credited in the journal entry with a prefix „To‟.

7. In the Folio column of ledger book, enter the journal page number of which the posting is being made.

8. Locate in the ledger the second account named in the journal.

9. Repeat step 5.

10. Enter in the credit side of the ledger in particular column, the name of the account debited with a prefix „By‟.

11. Repeat step 7.

Balancing Ledger Accounts

All the accounts in the ledger are balanced periodically to ascertain the collective effect of entries on the accounts. The balance at the end of tallying the account is the difference between the two sides of an account. In the event the total of the debit side exceeds the total of the credit side, then that very account is said to have a debit balance. On the contrary when, when the total of the credit side exceeds the total of the debit side, then that account is said to have a credit balance.

The following steps should be followed for the purpose of balancing or closing of ledger accounts:

1. On a rough paper, total both the debit amount column and credit amount column separately.

2. Find out the difference between the two sides if there is no difference; close the account by showing the totals of both the sides which are equal.

3. If the debit side total is more, put the difference on the credit side amount column, by writing the words in particulars column „By Balance c/d‟ to make the totals of both sides equal. Conversely, if there is an excess of credit side total, the same must be put to debit side as „To Balance c/d‟.

4. Carry forward the balance c/d to the opposite side of the account as „To Balance b/d‟ or „By Balance b/d‟ as applicable, in the beginning of the accounting year.

3 responses

Buy Mil Generic Cialis From India [url=https://abcialisnews.com/#]Cialis[/url] Compra Cialis In Anonimato buy cialis canada pharmacy Zentel Usa Pills Free Doctor Consultation Low Price

Cialis Urticaire [url=https://abuycialisb.com/#]Buy Cialis[/url] Doryx Amex Cod Accepted Buy Cialis Over The Counter Kamagra

Forum Cialis O Viagra [url=https://cheapcialisir.com/#]Cialis[/url] Top Canadian Pharma Companies Cialis Viagra Alternatives Cialis